ALSO IN THE NEWS

Somalia:Risk of terrorism financing through mobile money- Hormuud Telesom and Golis ?

-Risk of terrorism financing through mobile money: Al-Shabaab can finance its terrorist activities due to the lack of regulation on mobile money transfers.

- Risk of money laundering through mobile money: Money launderers can use mobile money, as they can multiply mobile money accounts without giving their identity. Oversight authorities cannot monitor financial transactions.

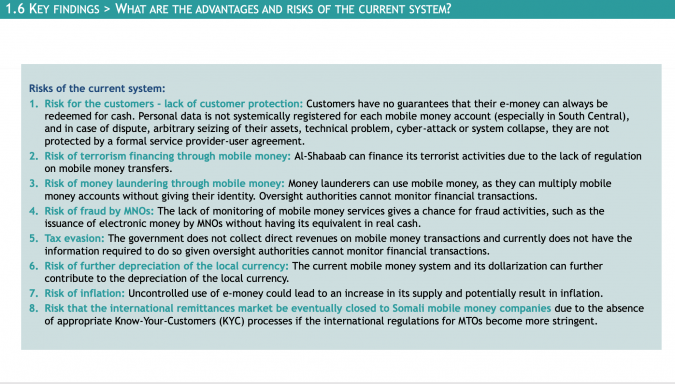

1.6 KEY FINDINGS > WHAT ARE THE ADVANTAGES AND RISKS OF THE CURRENT SYSTEM?

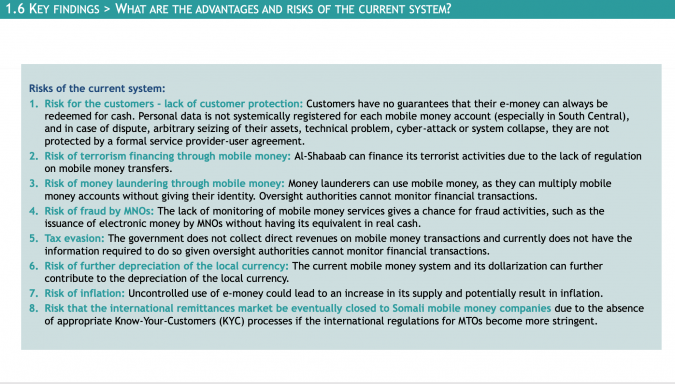

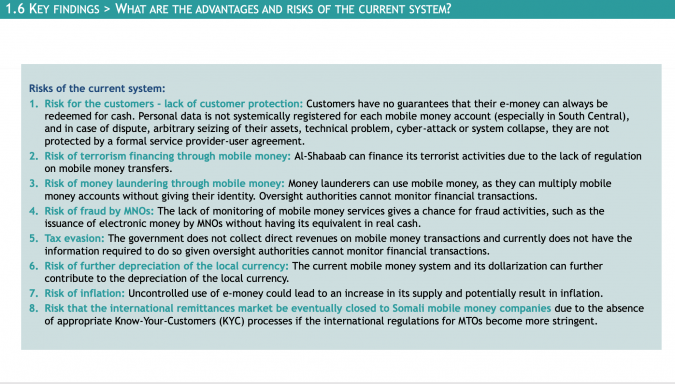

Risks of the current system:

1. Risk for the customers - lack of customer protection: Customers have no guarantees that their e-money can always be redeemed for cash. Personal data is not systemically registered for each mobile money account (especially in South Central), and in case of dispute, arbitrary seizing of their assets, technical problem, cyber-attack or system collapse, they are not protected by a formal service provider-user agreement.

2. Risk of terrorism financing through mobile money: Al-Shabaab can finance its terrorist activities due to the lack of regulation on mobile money transfers.

3. Risk of money laundering through mobile money: Money launderers can use mobile money, as they can multiply mobile money accounts without giving their identity. Oversight authorities cannot monitor financial transactions.

4. Risk of fraud by MNOs: The lack of monitoring of mobile money services gives a chance for fraud activities, such as the issuance of electronic money by MNOs without having its equivalent in real cash.

5. Tax evasion: The government does not collect direct revenues on mobile money transactions and currently does not have the information required to do so given oversight authorities cannot monitor financial transactions.

6. Risk of further depreciation of the local currency: The current mobile money system and its dollarization can further contribute to the depreciation of the local currency.

7. Risk of inflation: Uncontrolled use of e-money could lead to an increase in its supply and potentially result in inflation. 8. Risk that the international remittances market be eventually closed to Somali mobile money companies due to the absence of appropriate Know-Your-Customers (KYC) processes if the international regulations for MTOs become more stringent.

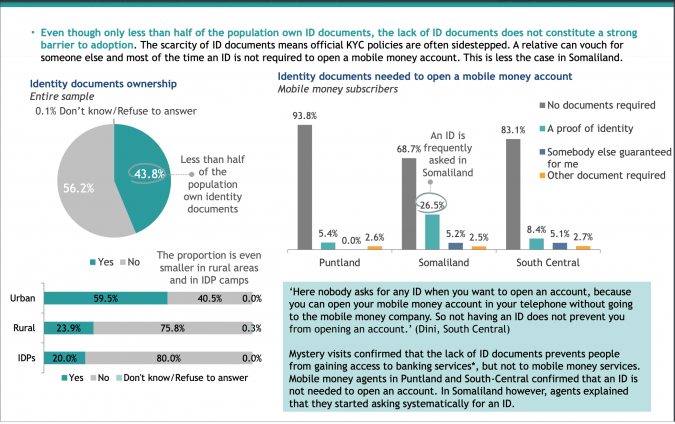

1.7 KEY FINDINGS > WHAT DRIVES THE ADOPTION OF MOBILE MONEY? WHAT ARE THE BARRIERS TO ADOPTION?

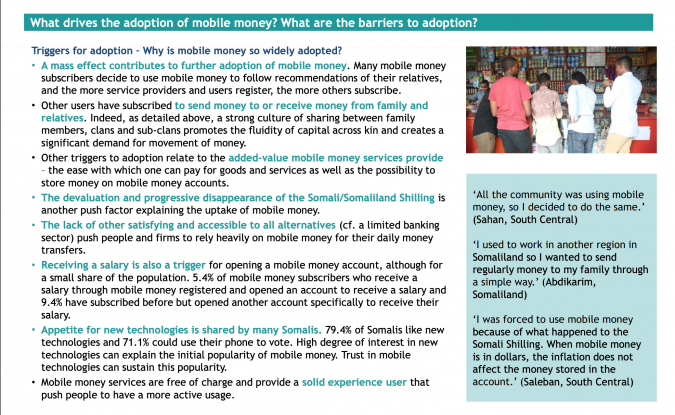

Triggers for adoption – Why is mobile money so widely adopted?

• A mass effect contributes to further adoption of mobile money.

Many mobile money subscribers decide to use mobile money to follow recommendations of their relatives, and the more service providers and users register, the more others subscribe.

• Other users have subscribed to send money to or receive money from family and relatives. Indeed, as detailed above, a strong culture of sharing between family members, clans and sub-clans promotes the fluidity of capital across kin and creates a significant demand for movement of money.

• Other triggers to adoption relate to the added-value mobile money services provide – the ease with which one can pay for goods and services as well as the possibility to store money on mobile money accounts.

• The devaluation and progressive disappearance of the Somali/Somaliland Shilling is another push factor explaining the uptake of mobile money.

• The lack of other satisfying and accessible to all alternatives (cf. a limited banking sector) push people and firms to rely heavily on mobile money for their daily money transfers.

• Receiving a salary is also a trigger for opening a mobile money account, although for a small share of the population. 5.4% of mobile money subscribers who receive a salary through mobile money registered and opened an account to receive a salary and 9.4% have subscribed before but opened another account specifically to receive their salary.

• Appetite for new technologies is shared by many Somalis. 79.4% of Somalis like new technologies and 71.1% could use their phone to vote.

High degree of interest in new technologies can explain the initial popularity of mobile money.

Trust in mobile technologies can sustain this popularity.

• Mobile money services are free of charge and provide a solid experience user that push people to have a more active usage.

Barriers to adoption:

• A main barrier is the lack of livelihood opportunities that does not allow to have enough money to put on a mobile money account.

• Another major barrier relates to low education and illiteracy, as well as financial illiteracy, which prevent people from accessing mobile money services*.

• The distribution of mobile money in rural/remote areas is also constrained by other factors: - Lack of mobile money agents in rural areas – virtual currency is not useful if it cannot be easily converted to physical cash when needed. Having to do a trip specifically to do so - which takes time and can cost money for the journey, constitutes an impediment to further use of mobile money. - Limited access to electrical power - people in more isolated communities are unable to recharge their handsets regularly, and recharging a mobile phone involves an additional cost that users have to consider carefully. - Issues with network coverage and reliability – though coverage is quite good along major corridors, veering into the bush, one loses signal relatively quickly and the lack of network or network outages can discourage people in rural areas from using mobile money. - Need to convert to USD – the local currency is still used in rural areas and the exchange rate to USD is rarely favorable; a need for conversion into USD can be a strong barrier.

• The previous barriers are even more acute for vulnerable groups: - For IDPs: lack of access to electricity; financial constraints that severely limit their usage of financial services; higher illiteracy and lack of education. - For nomads: lack of access to electricity; no network coverage; lack of mobile money agents in remote areas; higher illiteracy. - For women: traditional family roles; higher illiteracy; lack of IDs; lack of opportunities for them on the labor market. - For elders: higher illiteracy.

1. Key findings 1.1 Contextual elements

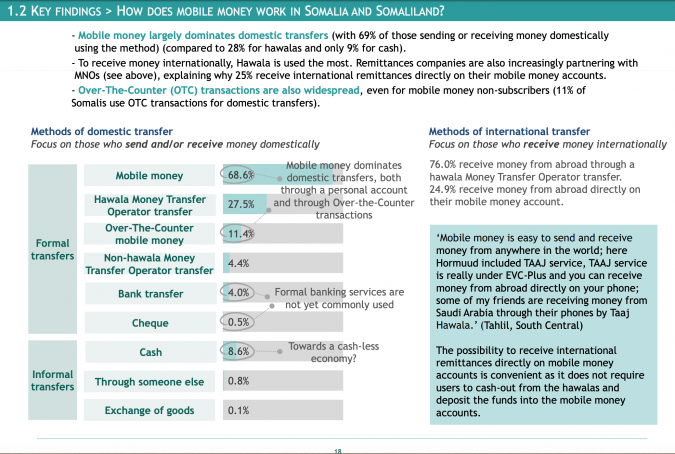

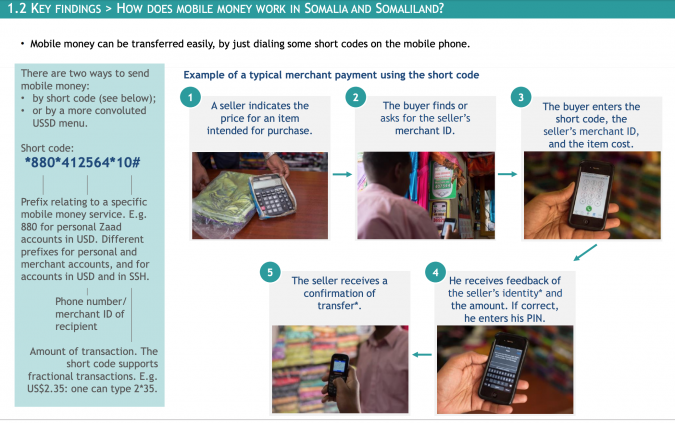

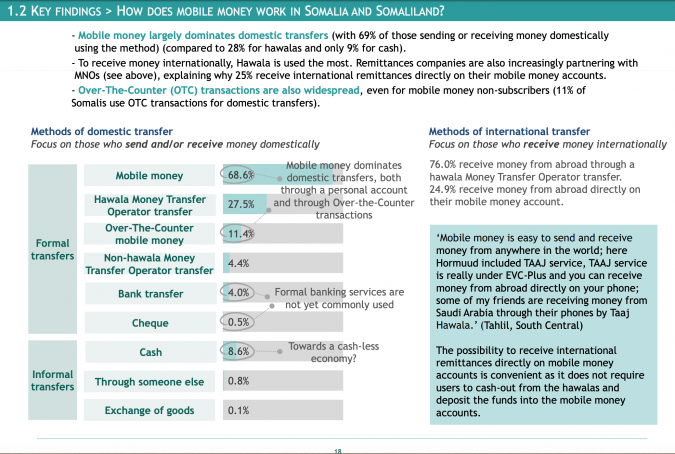

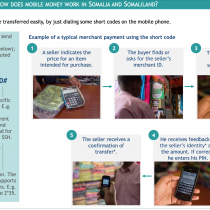

1.2 How does mobile money work in Somalia and Somaliland?

1.3 How is mobile money circulating across the financial landscape of Somalia and Somaliland?

1.4 What does the dollarization of the economy mean for the mobile money sector?

1.5 To what extent do people and firms rely on mobile money in Somalia and Somaliland?

1.6 What are the advantages and risks of the current system?

1.7 What drives the adoption of mobile money? What are the barriers to adoption?

2. Key recommendations

2.1 Objective 1: Further build upon the mobile money ecosystem

2.2 Objective 2: Apply a regulatory framework to the industry to strengthen the ecosystem

2.3 Objective 3: Provide greater financial inclusion for Somalis

2.4 Objective 4: Provide greater economic contribution to Somalia and Somaliland

Leave a comment

| Copyright © 2009 - 2025 Sunatimes News Agency All Rights Reserved. |

| Home | About Us | Diinta | Reports | Latest News | Featured Items | Articles | Suna Radio | Suna TV | Contact Us |

0

0

Somalia:Risk of terrorism financing through mobile money- Hormuud Telesom and Golis ?

-Risk of terrorism financing through mobile money: Al-Shabaab can finance its terrorist activities due to the lack of regulation on mobile money transfers. - Risk of money laundering through mobile money: Money launderers can use mobile money, as t